Stamp Duty Malaysia Calculation Property

Stamp duty fee 1.

Stamp duty malaysia calculation property. The stamp duty fee for the remaining amount will be 300 000 100 001 2 rm4 000. Latest update 2020 professional legal fees. The irb will impose stamp duties based on the valuation reported by jpph. Next rm 400 000 2.

Calculate now and get free quotation. Updates on stamp duty malaysia for year 2020 malaysia housing loan 2020. The stamp duty fee for the first rm100 000 will be 100 000 1 rm1 000. First rm 100 000 1.

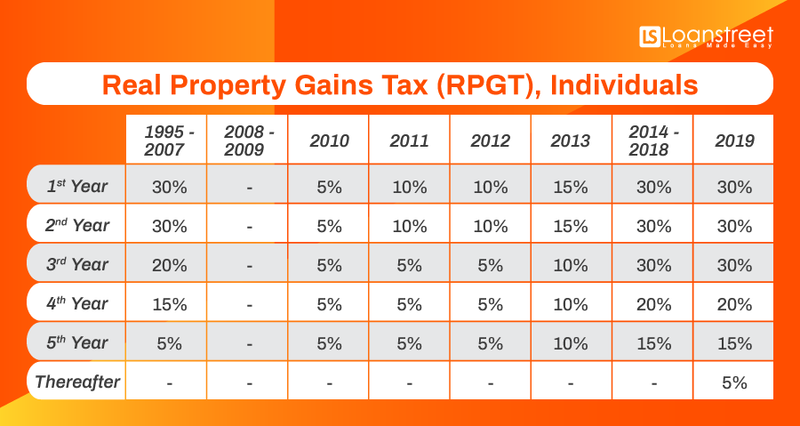

This means that for a property at a purchase price of rm300 000 the property stamp duty will be rm5 000. The stamp duty office sdo of the inland revenue board irb refers the prescribed form to jpph where the market value of the property is ascertained and reported within one 1 working day for standard sdo then informs the transferee lawyer of the duty payable. For some people buying a home is a significant milestone that tops many people s lifetime to do lists. Spa stamp duty and legal fees for malaysian property.

To know how much down payment lawyer fees and stamp duty needed are so. For first rm100 000 rm1000 stamp duty fee 2. Purchasing and hunting for a house can be an exciting and stressful experience. The actual calculation of stamp duty is before first time house buyer stamp duty exemption.

This means that for a property at a purchase price of rm300 000 the stamp duty will be rm5 000. Stamp duty calculation malaysia 2019 and stamp duty malaysia exemption. Rm7000 the actual stamp duty rm5000 maximum stamp duty exemption amount rm2000 00 this is because rm5000 is stamp duty for rm300 000 property value and this is also the maximum amount of the exemption. Calculate stamp duty legal fees for property sales purchase mortgage loan refinance in malaysia.

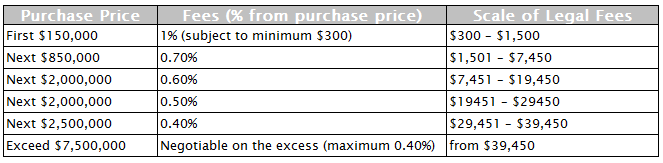

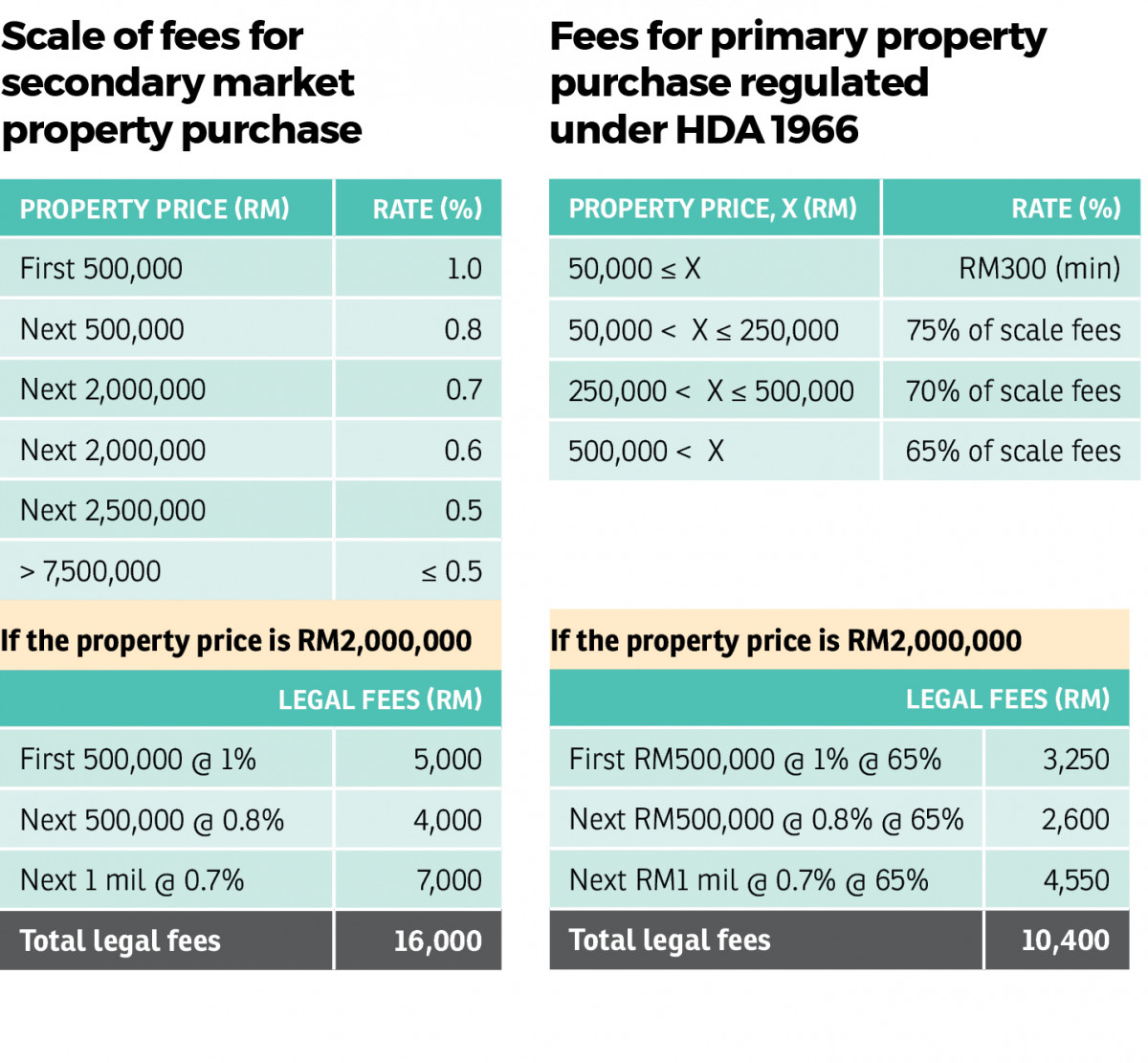

For the first rm500 000 00 1 0 subject to a minimum fee of rm500 00 for the next rm500 000 00 0 80. Legal fees stamp duty calculation 2020 when buying a house in malaysia. For the next rm2 000 000 00 0 70. The schedule below as a reference of stamp duty and legal fees when purchasing a house.

Property stamp duty. The property stamp duty fee for the first rm100 000 will be 100 000 x 1 rm1 000 the property stamp duty fee for the remaining amount will be 300 000 100 000 x 2 rm4 000.